You Can Help…

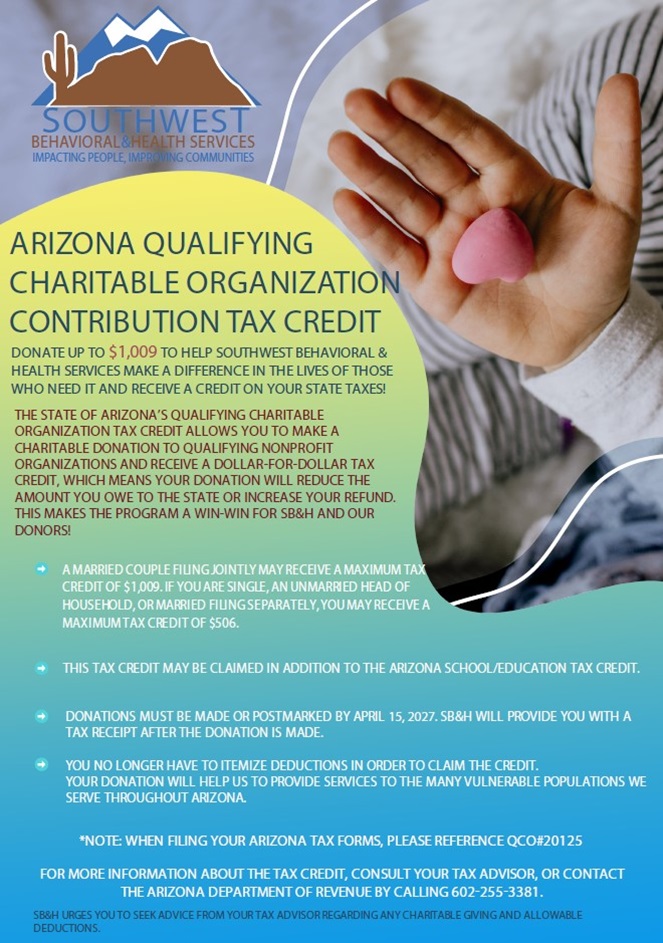

Donate up to $1,009 to Southwest Behavioral & Health Services with the AZ Tax Credit and get it all back in your Arizona Tax Refund.

Southwest Behavioral & Health Services is a Qualifying Charitable Organization (QCO: 20125).

Your AZ Tax Credit donation for charity to Southwest Behavioral & Health Services can be included in your Federal Tax Deductions in addition to the Arizona Charitable Tax Credit.

Please consult a qualified tax advisor for personal tax advice.

What is the Arizona Charitable Tax Credit?

The Arizona Charitable Tax Credit is a nonrefundable individual income tax credit for charitable contributions (QCOs). The maximum allowable credit for contributions to QCOs is $1,009 for married filing jointly filers or $506 for single, married filing separately, and heads of household filers.

These tax credits provide dollar-for-dollar tax benefits, allowing taxpayers to reduce their state tax liabilities for each dollar donated to charities, up to the maximum allowable limits.

Southwest Behavioral & Health Services is a 501(c)3 organization that qualifies for the Arizona Charitable Tax Credit. Donate now and get it back on your Arizona Tax Return.

Note: Arizona law allows QCO donations made during 2025 or donations made from January 1, 2026 through April 15, 2026 to be claimed on the 2025 Arizona income tax return. The maximum credit that can be claimed on the 2025 Arizona return for donations made to QCOs is $495 for single, married or filing separate or head of household taxpayers, and $987 for married filing joint taxpayers. If a taxpayer makes a QCO donation from January 1, 2026 through April 15, 2026 and wants to claim the higher 2026 maximum credit amount, the taxpayer will need to claim the credit on the 2026 Arizona return filed in 2027.

How does the Arizona Charitable Tax Credit Work?

1. Donate to a qualified charitable organization (QCO), such as a 501(c)3 organization like Southwest Behavioral & Health Services.

2. Maintain a receipt of your gift from the charity, in order to provide a copy with your tax return.

3. Complete Arizona Form 321 for gifts to QCOs to claim credit for your donation.

4. Calculate your individual tax return (e.g. Arizona Form 140, 140NR, 140PY, or 140X), subtracting your tax credits from your tax liability, in order to reduce your Arizona state tax balance. Include Arizona Form 321 with this return.

Donate By Credit Card • Donate By Cash or Check • Donate Other Items

You Can Help…

Your tax-deductible cash contribution will be greatly appreciated and put to immediate use by enabling us to help those who are in the greatest need of assistance.

Mail Check Donation / Drop Off Cash Donation

Southwest Behavioral & Health Services Inc.

3450 North 3rd Street

Phoenix, Arizona 85012

Federal Tax ID: 86-0290033

Donate Other Items

Water, socks, hygiene kits (including toothpaste, toothbrushes), sunscreen, shoes, lip balm, hats or caps, lightweight t-shirts, underwear, art/craft supplies and musical instruments.

To donate the above items please contact 602-265-8338.

Credit Card Donation

(Use your credit card to donate through our PayPal account)

Disclaimer: As a non-profit 501(c)(3) organization, donations to Southwest Behavioral Health Services may be eligible for deduction on your state and federal income tax returns. A written receipt will be sent to you to as support documentation as required by the IRS. Please consult your personal tax advisor to determine your eligibility for the deduction. Please note that contributions are non-refundable.